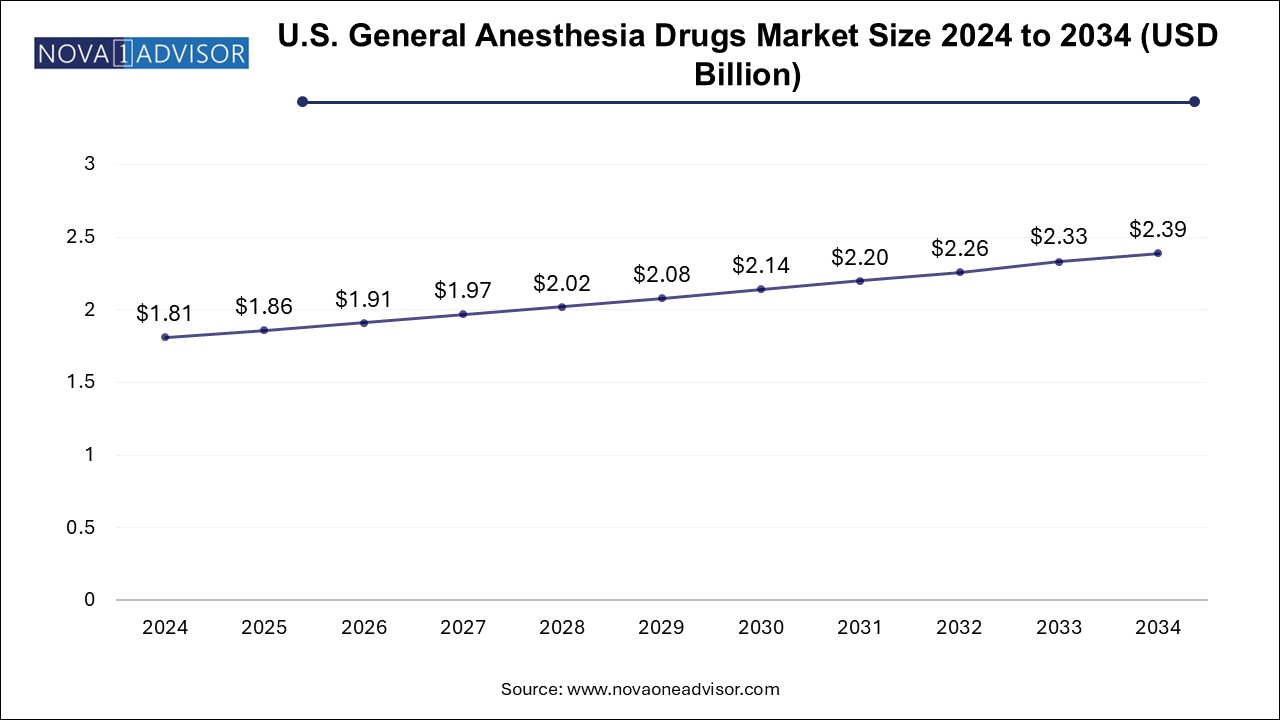

The U.S. general anesthesia drugs market size was exhibited at USD 1.81 billion in 2024 and is projected to hit around USD 2.39 billion by 2034, growing at a CAGR of 2.83% during the forecast period 2025 to 2034.

The U.S. general anesthesia drugs market forms a critical component of the country’s surgical and perioperative care landscape. General anesthesia drugs are essential pharmaceutical agents used to render patients unconscious and insensible to pain during major surgical procedures. These drugs enable a controlled and reversible state of unconsciousness, combined with amnesia and muscle relaxation, allowing surgeons to perform complex interventions safely and effectively. The drugs used in general anesthesia may be administered intravenously or inhaled, and often work in combination to optimize induction, maintenance, and recovery.

In the U.S., the demand for general anesthesia drugs continues to rise in parallel with the increasing surgical caseload, including elective procedures, cancer-related interventions, orthopedic replacements, cardiovascular operations, and ambulatory surgeries. As the U.S. population ages and chronic disease burden intensifies, the volume of surgeries is expected to grow substantially, driving the consumption of general anesthetics. Furthermore, technological advances in anesthetic monitoring, dosing precision, and drug delivery systems are enhancing the safety and efficacy of anesthesia management.

The U.S. is one of the most mature healthcare markets globally, supported by advanced surgical infrastructure, high healthcare expenditure, and a robust pharmaceutical ecosystem. This creates a highly conducive environment for the growth of general anesthesia drugs. Innovations in anesthetic agents with shorter onset and faster recovery times, improved side-effect profiles, and better pharmacokinetics have resulted in new formulations and drug combinations becoming widely adopted across healthcare settings.

Additionally, the growing penetration of ambulatory surgical centers (ASCs), minimally invasive procedures, and outpatient interventions is influencing anesthetic choices. Clinicians increasingly favor agents with shorter half-lives and faster patient turnaround to improve care quality while optimizing resource use. The U.S. market also benefits from strong regulatory frameworks, frequent clinical trials, and the presence of several global pharmaceutical manufacturers focused on expanding their anesthesia portfolios.

Shift Toward Short-acting Agents: Preference for anesthesia drugs with rapid onset and faster recovery times, enabling same-day discharge in outpatient settings.

Increasing Use of Total Intravenous Anesthesia (TIVA): A growing number of anesthesiologists are adopting TIVA protocols using agents like propofol and remifentanil for enhanced control.

Rise in Outpatient and Ambulatory Surgeries: The growing number of ASCs in the U.S. is altering anesthesia drug demand toward faster-acting and easy-to-administer agents.

Multimodal Anesthesia Protocols: Combinations of hypnotics, analgesics, and muscle relaxants are increasingly used to improve safety and patient outcomes.

Advancements in Anesthesia Monitoring Systems: Technology-driven monitoring is allowing more precise titration of anesthetics, reducing drug overuse and recovery time.

Addressing Anesthetic Drug Shortages: Hospitals are working with manufacturers to mitigate shortages through diversified sourcing and reformulation.

Geriatric Population Growth: Increasing numbers of elderly patients requiring surgeries is boosting demand for general anesthesia drugs with favorable cardiovascular and cognitive safety profiles.

Adoption of Environmentally Safer Inhalants: Concerns about volatile anesthetic greenhouse gas effects are influencing the development of new inhaled agents.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.86 Billion |

| Market Size by 2034 | USD 2.39 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 2.83% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Drug, Route of Administration, End-use, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Baxter International Inc.; AstraZeneca; AbbVie Inc.; B. Braun Melsungen AG; Fresenius SE & Co. KgaA; Pfizer; Hospira Inc.; Aspen Pharmacare Holdings Limited; Hikama Pharmaceuticals plc; Abbott Laboratories |

One of the most prominent drivers of the U.S. general anesthesia drugs market is the continual rise in surgical procedures, largely fueled by an aging population and increasing prevalence of chronic conditions. According to the CDC and AHA, millions of Americans undergo surgeries each year for cardiovascular issues, cancer removal, joint replacements, gastrointestinal conditions, and more. The aging demographic—particularly those aged 65 and above—is most likely to require invasive interventions, often necessitating general anesthesia.

Older patients tend to undergo multiple surgeries across their lifetime, ranging from orthopedic replacements to cardiac bypasses and oncological resections. This demographic trend is translating into higher consumption of general anesthetics. In addition, advances in surgical techniques, such as minimally invasive robotic-assisted surgeries, are making procedures safer for older adults, further increasing surgical volumes. The growing reliance on anesthetics in outpatient procedures, dental surgeries, and diagnostics (like MRIs for claustrophobic patients) is also contributing to the demand for general anesthesia drugs across healthcare settings.

Despite the widespread use of general anesthesia drugs, the market is constrained by safety concerns associated with anesthetic administration, especially in high-risk populations such as the elderly, pediatric patients, and those with comorbidities. Adverse effects of general anesthetics can include nausea, vomiting, hypotension, respiratory depression, and in rare cases, malignant hyperthermia or anaphylaxis. Prolonged exposure to certain inhalation agents like sevoflurane and isoflurane has also raised concerns regarding potential cognitive decline in older adults.

Furthermore, anesthetic drugs must be administered by trained professionals under close monitoring, limiting their use in lower-resource environments or during drug shortages. Patient-specific variability in drug metabolism and sensitivity also makes standardized dosing complex. Additionally, there is growing concern regarding the environmental impact of inhaled anesthetics, many of which are potent greenhouse gases. These factors challenge the market by prompting a reassessment of clinical protocols and demanding innovation in drug design and delivery systems.

A promising opportunity in the U.S. general anesthesia drugs market lies in the development of novel formulations and personalized anesthesia protocols. There is increasing interest in new anesthetic agents with optimized pharmacokinetic profiles, reduced toxicity, and minimal drug-drug interactions. Pharmaceutical companies are investing in next-generation versions of existing drugs (e.g., liposomal propofol, ultra-short-acting remifentanil) as well as exploring non-opioid adjuvants for enhanced multimodal anesthesia.

Another frontier is the integration of pharmacogenomics and AI-based anesthesia decision-support tools. Personalized anesthesia, guided by patient-specific factors such as genetic polymorphisms, weight, age, and liver/kidney function, is emerging as a focus area. Personalized drug dosing could reduce complications, accelerate recovery, and minimize side effects. As hospitals move toward value-based care and patient-centric outcomes, anesthesia customization and innovation offer attractive pathways for clinical differentiation and cost savings.

Propofol dominated the U.S. general anesthesia drugs market in 2024, due to its broad usage for induction and maintenance of anesthesia, especially in ambulatory and short-duration procedures. Propofol is prized for its rapid onset, predictable recovery, and antiemetic properties, making it a preferred agent for both inpatient and outpatient surgical care. Its versatility also extends to sedation during diagnostic procedures, intensive care unit (ICU) use, and total intravenous anesthesia (TIVA) protocols. With the rising preference for minimally invasive surgeries and the increasing adoption of TIVA, propofol’s market share remains significant.

Dexmedetomidine is projected to be the fastest-growing segment, largely due to its unique mechanism as a selective alpha-2 adrenergic agonist. It offers sedation without significant respiratory depression and is increasingly favored for use in ICU sedation, procedural anesthesia, and opioid-sparing protocols. As concerns grow around opioid use and postoperative delirium—especially in elderly or critically ill patients—dexmedetomidine is emerging as a valuable alternative in multi-drug anesthesia regimens. Ongoing clinical trials are exploring its expanded applications, which is likely to propel its market growth further.

The Intravenous administration is the dominant route, primarily due to the widespread use of agents like propofol, midazolam, and remifentanil. IV anesthesia allows for precise control over drug concentration, immediate onset, and reduced nausea, which is particularly beneficial in outpatient and short-stay procedures. Hospitals and ASCs favor IV agents for rapid induction and smoother recovery in high-throughput environments.

Inhaled anesthetics, while less dominant, remain essential, particularly for maintenance in longer surgeries. Agents like sevoflurane and desflurane are widely used due to their low blood-gas solubility, enabling quick induction and emergence. Desflurane’s role is expanding in bariatric and elderly surgeries due to faster recovery. However, environmental concerns and the growing use of TIVA may slightly moderate inhaled anesthetics’ future share.

General surgeries held the dominant application share, encompassing a wide range of procedures from appendectomies and hernia repairs to gastrointestinal and thoracic interventions. These operations commonly use a combination of IV induction and inhaled maintenance, ensuring steady drug consumption.

Knee and hip replacements are the fastest-growing application, driven by rising orthopedic surgeries in the aging population. Total joint replacements increasingly use general or combined anesthesia techniques, and the high volumes of these procedures—often bundled under Medicare or private insurance—make them a key revenue driver for anesthesia drug providers. Advances in anesthesia protocols for fast-track orthopedic recovery are also contributing to growth.

Hospitals remain the largest end-use segment, accounting for the majority of general anesthesia drug consumption. They manage high-acuity, complex, and inpatient surgeries that necessitate controlled, multi-phase anesthesia. Hospitals also maintain extensive anesthesiology departments and have integrated monitoring systems for post-anesthesia recovery. The consolidation of surgical services in hospital settings further strengthens their leading position.

Ambulatory surgical centers (ASCs) are the fastest-growing end-use segment, spurred by cost-efficiency, shorter wait times, and the shift of elective procedures to outpatient settings. ASCs increasingly perform procedures such as colonoscopies, orthopedic repairs, and cataract surgeries—all requiring fast-acting anesthetic agents. This has led to higher adoption of short-duration drugs like remifentanil and propofol, boosting their sales in the ASC segment.

In the United States, the general anesthesia drugs market is deeply integrated into the broader surgical ecosystem. The U.S. performs one of the highest numbers of surgeries per capita globally, with robust healthcare infrastructure, clinical staffing, and reimbursement mechanisms supporting general anesthesia utilization. The rise of outpatient surgeries and enhanced recovery after surgery (ERAS) protocols are pushing hospitals and ASCs to adopt anesthetic agents with predictable pharmacodynamics and minimal recovery delays.

Major metropolitan areas host high volumes of elective procedures and specialty hospitals, while rural health centers are increasingly being equipped with advanced anesthetic tools. Regulatory oversight by the FDA ensures drug safety and encourages innovation in formulations. Moreover, medical schools and residency programs emphasize evidence-based anesthetic protocols, contributing to professional uptake of new drug combinations and technologies. The U.S. market also benefits from a strong presence of pharmaceutical R&D, with clinical trials consistently evaluating next-gen anesthesia molecules, providing a dynamic pipeline for future growth.

In March 2025, Fresenius Kabi launched a new ready-to-use propofol formulation, reducing preparation time in surgical and critical care settings.

In January 2025, Hikma Pharmaceuticals received FDA approval for a generic version of dexmedetomidine, expanding access in U.S. hospital networks.

In October 2024, Baxter International expanded its partnership with ASCs, offering bundled anesthesia supply kits featuring sevoflurane and remifentanil.

In September 2024, Pfizer announced early-stage trials for a novel opioid-sparing anesthetic adjunct, targeting safer post-operative recovery profiles.

In July 2024, the ASA (American Society of Anesthesiologists) released updated clinical guidelines endorsing multimodal anesthesia and risk-adjusted agent selection in elderly patients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. general anesthesia drugs market

By Drug

Others - (Sufentanil, Fentanyl, Ketamine, Isoflurane, Thiopental, etc.)

By Route of Administration

By End-use

By Application